Table of Content

But sometimes VA loans do go into default and the lender is forced to foreclose. Yet even in this unfortunate event, the lender again appreciates the VA loan program because it comes with a guarantee. Lenders will submit requests for remittance and request the loan guaranty certificate, through the Guaranty Remittance API and receive an appropriate response based on the data and scenario they are testing. VA may suspend from the loan program those who take unfair advantage of Veterans or discriminate because of race, color, religion, sex, disability, family status, or national origin. Veterans who are not Native American, but who are married to Native American non-Veterans, may be eligible for a direct loan under this program.

You might expect with a government-backed mortgage there will be some additional paperwork involved and the VA loan is no exception. You’ll have to obtain your Certificate of Eligibility for example from the VA. A loan officer with VA home loan experience knows to order that document directly from the VA instead of you having to mail, fax or otherwise make your request on your own. There is also what is known as “residual income” requirements for a VA home loan that other programs do not have.

If you have remaining entitlement, you do have a home loan limit

ODVA will now accept loans up to the new maximum loan amount of $726,200, an increase of $79,000 from $647,200 in 2022, for funding on or after January 1, 2023. Veterans with non-VA guaranteed home loans now have new options for refinancing to a VA-guaranteed home loan. These new options are available as a result of the Veterans’ Benefits Improvement Act of 2008.

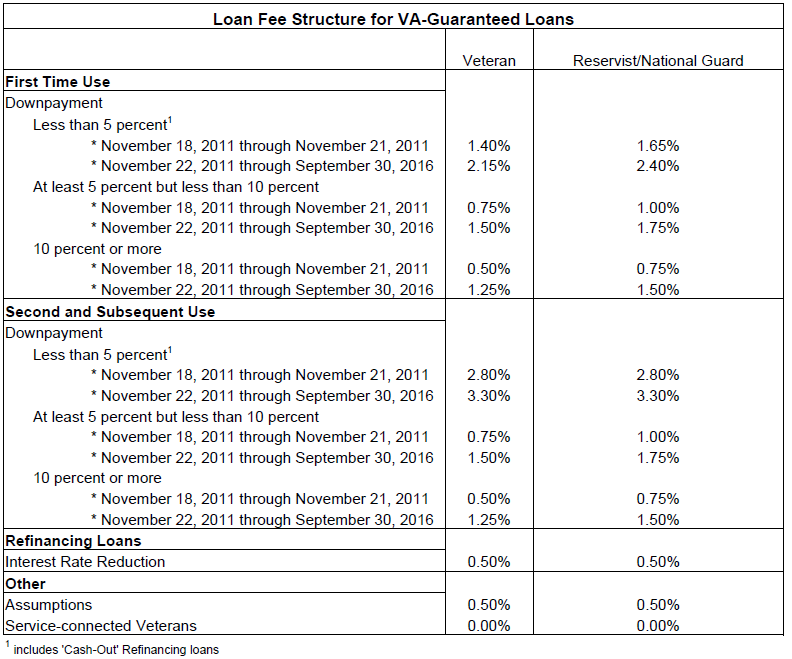

If approved, the purchaser will have to pay a funding fee that the lender sends to VA, and the Veteran will be released from liability to the federal government. VA home loan guaranties are issued to help eligible Servicemembers, Veterans, Reservists, National Guard members, and certain surviving spouses obtain homes, condominiums, and manufactured homes, and to refinance loans. For additional information or to obtain VA loan guaranty forms, visit /homeloans/.

Get help from Veterans Crisis Line

A VA guaranteed home loan offers a number of safeguards and advantages over a non VA guaranteed loan. For example, the interest rate is competitive with conventional rates with little or no down payment required. A VA guaranteed home loan is made by private lenders, such as banks, savings and loan associations, and mortgage companies.

Veterans, Servicemembers, and their families may open eBenefits accounts. Starting January 1, 2020, we will waive the cap on VA no-down-payment loans in certain circumstances. You may get a no-down-payment, VA-backed loan in any area of the country, regardless of home prices. Sometimes those with other than an honorable discharge may qualify for VA benefits. To get VA benefits, your discharge or service must be honorable; Reserve and National Guard members must have an honorable discharge.

VA Home Loans

You or your spouse must certify occupancy for the property. A dependent child of an active duty Servicemember may also satisfy the occupancy requirement. Commissioned Officers of the Public Health Service and National Oceanic and Atmospheric Administration qualify as active duty members and Veterans once discharged. The builder of a new home is required to give the purchasing veteran either a one-year warranty or a 10-year insurance-backed protection plan.

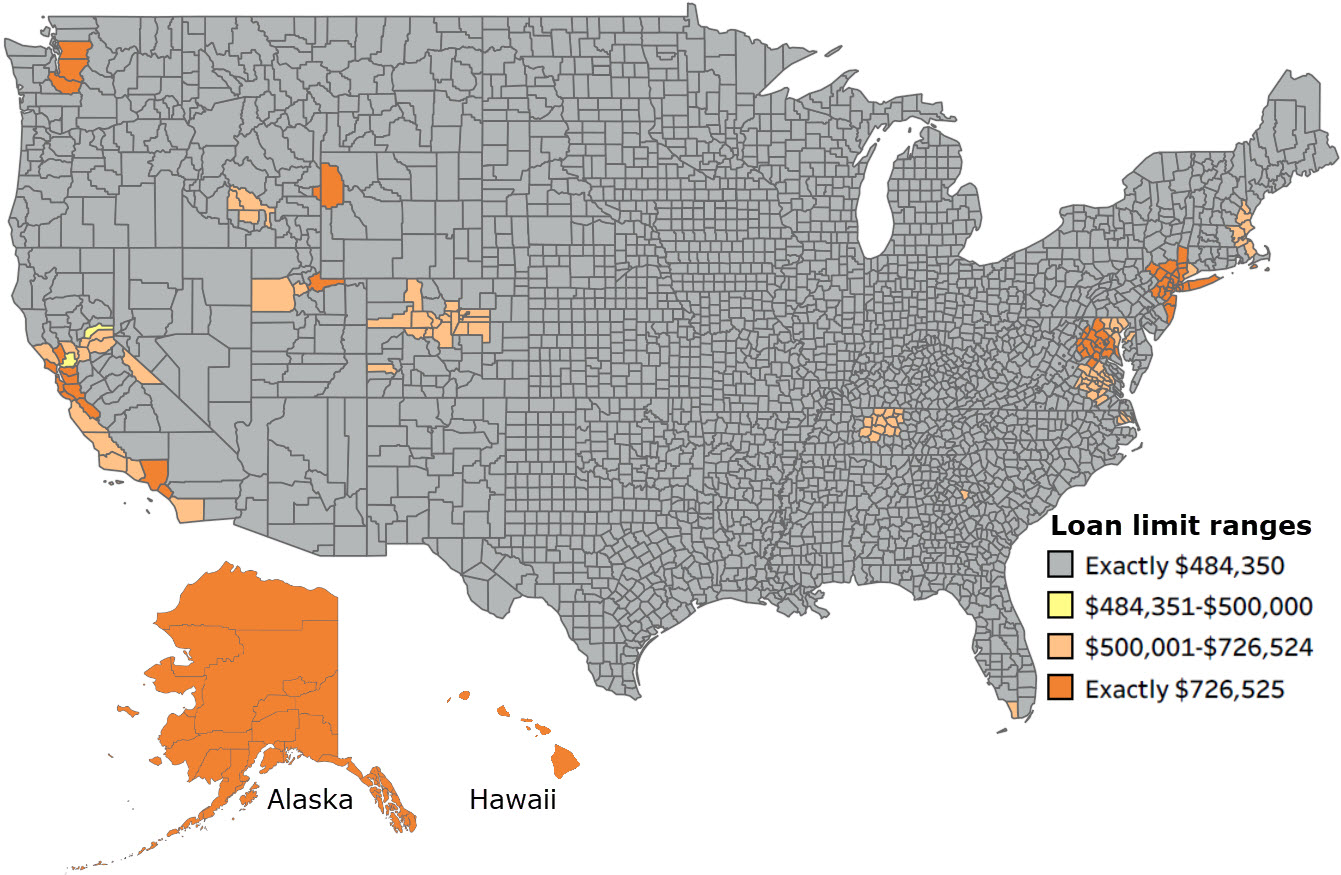

A thorough inspection of the property by a reputable inspection firm may help minimize any problems that could arise after loan closing. In an existing home, particular attention should be given to plumbing, heating, electrical, and roofing components. VA home loan limits are the same as the Federal Housing Finance Agency limits. One final note here, it’s always important to make sure the lender you choose is experienced with the VA home loan process.

Guaranty Remittance Overview

The Technology Provider aid below outlines the required steps for Technology Providers to gain access to the partner test environment. The Guaranty Remittance API will make the process of remitting the Funding Fee and obtaining the Loan Guaranty Certificate automatic through the lender’s loan origination system. Lenders will be able to leverage Funding Fee rules to prevent remittance errors. All this will decrease data entry and errors while also increasing efficiency and data security and a better overall loan product for Veterans. The Veteran obtaining a loan may only be charged closing costs allowed by VA. Discharge under conditions other than dishonorable or early discharge for service-connected disability.

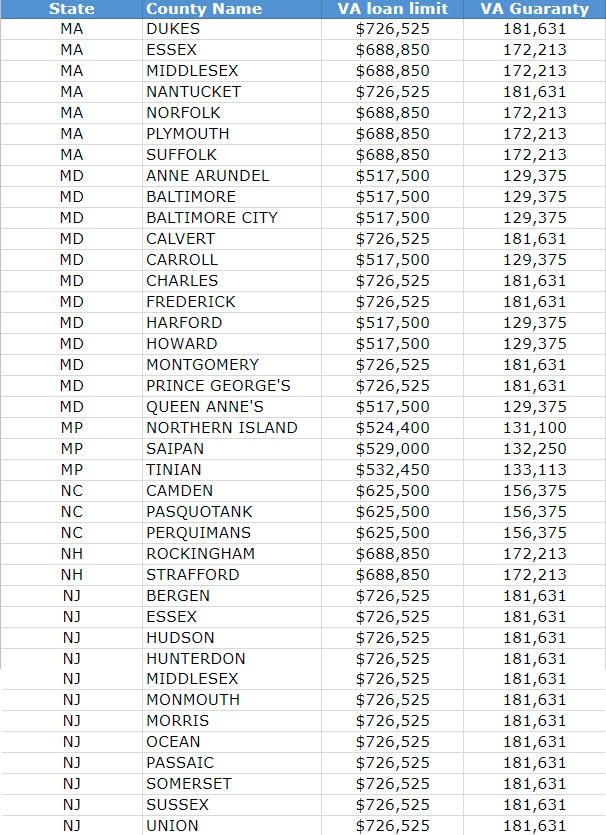

However, certain high cost counties can have conforming limits higher than $417,000. This is to adjust for the higher cost of real estate in some areas. It’s rare, but some counties have VA loan limits that exceed $1 million, other counties have limits above $417,000 but less than $1 million.

VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy. A release of liability does not mean that a Veteran’s guaranty entitlement is restored. That occurs only if the borrower is an eligible Veteran who agrees to substitute his or her entitlement for that of the seller. Veterans obtain VA-guaranteed loans through the usual lending institutions, including banks, credit unions, and mortgage brokers. VA-guaranteed loans can have either a fixed interest rate or an adjustable rate, where the interest rate may adjust up to one percent annually and up to five percent over the life of the loan.

Under the VA-guaranteed Home Loan program, VA does not make the loan to you. The guaranty amount is what VA would pay a lender should your loan go into foreclosure, deed-in-lieu, or short-sale. VA may suspend from the loan program those who take unfair advantage of veterans or discriminate because of race, color, religion, sex, disability, family status, or national origin. A significant benefit of military service is the VA home loan, allowing you to purchase a home with no down payment or refinance a home. If the lender charges discount points on the loan, the Veteran may negotiate with the seller as to who will pay points or if they will be split between buyer and seller. Points paid by the Veteran may not be included in the loan .

Loan limits were effectively raised from $144,000 to $417,000. These changes will allow more qualified Veterans to refinance through VA, allowing for savings on interest costs and avoiding foreclosure. All Veterans, except those who are specified by law as exempt, are charged a VA funding fee . Additionally, unmarried surviving spouses in receipt of Dependency and Indemnity Compensation may be exempt from the funding fee. For all types of loans, the loan amount may include this funding fee.

It is important to note that VA does not impose a maximum loan amount that a Veteran may borrow to purchase a home; instead, the law directs the maximum amount that VA may guarantee on a home loan. Because most VA loans are pooled in mortgage securities that require a 25 percent guaranty, the effective no-downpayment loan limit on VA loans tends to be four times VA’s maximum guaranty amount. Loans for more than the effective no-downpayment loan limit generally require downpayments. Then, VA’s effective no-downpayment loan limits are established annually, and vary, depending on the size of the loan and the location of the property. Are established annually, and vary, depending on the size of the loan and the location of the property.

VA-Guaranteed Home Loan Program

The VA has established lending guidelines that make it easier for a veteran or active duty service member to buy and finance a home to live in. Buyers don’t have to come up with a down payment which keeps many buyers on the sidelines longer when trying to save up enough money for a down payment and closing costs. Not having to jump over that hurdle is a big plus for veterans. An eligible borrower can use a VA-guaranteed Interest Rate Reduction Refinancing Loan to refinance an existing VA loan to lower the interest rate and payment.

Download the loan limit table by selecting the link to the right of the Description column. You can use your remaining entitlement—either on its own or together with a down payment—to take out another VA home loan. The borrower can prepay without penalty the entire loan or any part not less than one installment or $100. To understand the VA guarantee, one might think of VA loans in terms of small, medium and large. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here.